Knowledge Center

Knowledge Center

Quarterly Newsletter – Q1 2022

A Down Open to the Year

Market Comment

The year’s opening quarter was marked by a confluence of headwinds for investment markets, and some were quite unexpected. Just as the global economy was gathering vigor after nearly two years of pandemic, Russia commenced an unprovoked war of aggression against Ukraine. The economic impact from the conflict compounded pressures within a global market system still coming to terms with fast-rising interest rates and sharply higher inflation.

Volatility is elevated, and the investing backdrop is more complicated and mired in uncertainty than typical. Both equity and fixed income markets encountered dramatic swings in the period, both being pressured by rising rates. Despite the stresses, equity markets rallied back from deeper correction territory during the final weeks of March to close the first quarter with moderate losses. Value-orientated stocks handily outperformed their growth counterparts. Returns on foreign investments were negatively impacted by rising geopolitical risks and a stronger dollar in the quarter. Beset by higher rates and wider credit spreads, fixed income returns finished the quarter in the red.

The Impact of War

Russia’s invasion of Ukraine in late February drew widespread condemnation from countries around the world and reinvigorated, for the moment, the traditional Western alliances of NATO and the EU. Though the US and its allies are thus far avoiding a direct military confrontation with Russia, they have undertaken a range of tough sanctions designed to impede Russia economically. Led by the US, assets of Russia’s central bank were frozen, and the West undertook coordinated steps to deny Russia access to the global financial system. Wealthy Russian “oligarchs” who have benefited from Putin’s rule were not spared either, with many seeing their international accounts frozen and other assets, such as large yachts, seized.

A large number of major international corporations have withdrawn from Russia, or at least are temporarily suspending their operations. Leaders in Germany and other European countries are hurriedly drawing up plans to reduce their dependence on Russian energy, and speed up the roll-out of renewable energy. In just slightly over a month since the war started, Russia has isolated itself from the west, and has largely failed in its war aims to topple the Ukrainian government and subdue the populace. Peace talks have been unproductive to date. There is much distrust between the countries, aggravated by the targeting of Ukrainian civilians for violence and deliberate terror.

The miliary conflict and ensuing sanctions will have spillover effects on the rest of the world. Energy prices, already rising before the invasion, spiked further on concerns over the security of oil and natural gas supplies. As noted, Russia is a major oil producer to the world and a significant natural gas supplier to Western Europe. Food costs may also rise further from disruptions to the planting season in Ukraine, which is a significant producer of wheat.

Should they persist, elevated energy costs will take a toll on global growth, offset in part by increased production and conservation measures. We suspect, though, that energy supplies will continue to remain tight from sector underinvestment and continued demand growth.

Inflation Surges

The invasion amplified existing concerns over inflation pressures, with rising energy, food, and services prices pushing US inflation to a 40-year high. Gas prices shot up at their fastest rate on record, although prices have moderated a bit recently. With gas prices so visible–posted in giant numbers alongside roads and every highway in the country–they tend to have an outsized influence on consumers’ perceptions of inflation and the economy.

We view the present inflation situation as driven by both supply and demand factors. Re the former, it may be more accurate to describe the relative lack of supply for many consumer goods that has driven up their price. Examples abound, from new cars to building materials to even clothing and shoes. In each case, supply chain disruptions engendered by the pandemic served to limit the accustomed availability of these goods and more to the consumer.

The demand side of the current inflation has been spurred by a recovering economy, strong nominal wage growth, and historic government transfer payments related to the pandemic response, especially PPP loans and three rounds of household stimulus checks. If we define an inflation as too many dollars chasing too few goods, we scored bullseyes on both sides of that equation. The one-time effect of these transfers should burn off as time passes, but we expect consumer demand to remain firm as the post-pandemic economy normalizes. At present, household balance sheets remain healthy, supported by an abundance of jobs and rising wages, and residual stimulus cash.

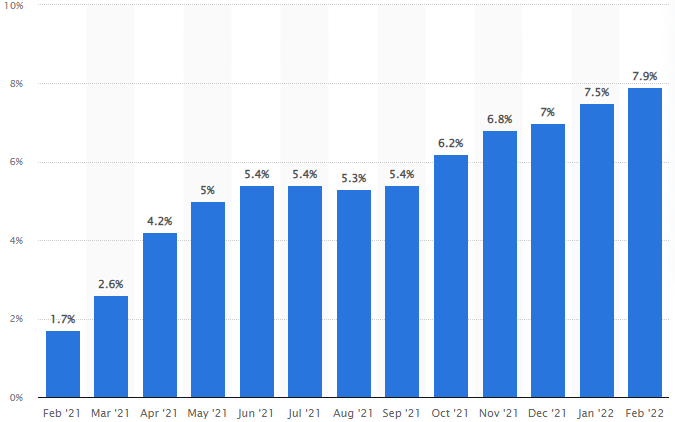

US Inflation Rate

Year-Over-Year Change

Source: US Bureau of Labor Statistics

Federal Reserve Combats Inflation

By law, the Federal Reserve has two goals with respect to the economy: promote maximum employment, and maintain stable prices. Its main policy tool is the adjustment of interest rates. The Fed sets the short-term borrowing rate for commercial banks, which in turn influences the rates those banks pass along to consumers and businesses on everything from credit cards to mortgages to car loans.

During the onset of the covid crisis, the Federal Reserve reacted swiftly by cutting its key interest rate to zero. It also injected additional liquidity into the economy by expanding its balance sheet by more than $4.5 trillion. The bold policy moves generally earned praise, and likely reduced and shortened the economic pain felt in the US.

Generally, the central bank aims to keep inflation around 2% annually, a number that lagged before the pandemic. At last measure, the figure is now 7.9%. Just as how the Fed stoked demand by cutting interest rates, the central bank is now trying to tame demand by raising them.

As widely expected, the Federal Reserve voted in March to increase the federal funds rate by 0.25%. Balance sheet reduction (“Quantitative Tightening,” or QT) is expected to start in May, too, and may ultimately have a greater market impact than Fed rate hikes. The geopolitical situation adds some uncertainty to the central bank’s hiking cycle over the coming year, but Fed officials indicated an aggressive hawkish path ahead, with rate rises coming at each of the remaining six meetings in 2022.

Regulating policy to ensure a soft landing for the economy will not be easy. The Fed faces a delicate challenge, with risks on both sides: inadvertently falling behind inflation by not raising rates fast enough, or tightening credit too aggressively and thereby undercutting the economy, possibly triggering a recession.

Recession Signals Beginning to Glow, though Economy Remains Strong for Now

The bond market has been flashing warning signs of late. Perhaps most concerning, the widely followed yield curve between two- and ten-year Treasurys has inverted. When the yield curve inverts for long stretches of time beyond a few days or weeks, the implication is that the Fed will be easing monetary policy in the future to cope with growth challenges from a softer economy.

Another popular indicator is the price action on the Dow Jones Transportation Average index, comprising a list of leading railroad, airline, trucking, transportation and logistics companies. Often used as a barometer on the overall economy, this index has recently edged into bear market territory as well.

Neither the yield curve nor the Dow Transport index is definitive on its own as future economic signals. We suspect signals from the yield curve have been largely distorted from over a decade of massive quantitative easing by global central banks, suppressing absolute yield levels, affecting the direction of long-dated Treasury yields, and impairing overall price discovery. Likewise, the Dow Transports are not as compelling a “tell” on our modern economy, which has become more driven by services and less by the production and movement of goods.

Looking deeper into the economy, we observe that the labor market continues to have substantial positive momentum. Employment growth powered through another difficult wave of covid, adding nearly 1.6 million jobs over the past three months. Major industries like housing and autos have been severely supply constrained, and must catch up due to strong pent-up demand. Despite higher inflation, American households still have a healthy amount of excess savings to help weather the higher prices.

Our Outlook

We think the ongoing geopolitical crisis is unlikely to have a quick ending. The Ukrainian resistance is heroic, and at present Putin has few alternatives to prosecuting further his war. Sanctions will only have an impact in the longer term, although on their present course, they will weaken Russia strategically, limiting the country’s access to Western technology, finance, and support across a host of industries. Market disruptions resulting from the war are likely not done; there are a range of possible outcomes that can impact global industries or present even more dangerous situations, such as direct conflict between Russian and NATO militaries.

The economy is likely to slow from its tempo at the end of 2021, especially if gas and food prices remain elevated for a prolonged period. We are entering this new phase from a position of strength, which should provide some support. Fundamentals are mostly solid, wages are rising, job opportunities are aplenty, and consumer balance sheets are strong. The situation surrounding supply bottlenecks should continue to improve, benefiting the rebuilding of inventory and easing of inflationary pressures.

The biggest question on investors’ minds is whether the Federal Reserve can engineer a soft landing, and avoid a recession, as it carries out its policy tightening moves. Nobody has an answer to this yet. Volatility will likely remain choppy in the near-term. We remain confident on the long-term prospects of our holdings, but believe the current environment calls for a balancing act that increases focus on inflation protection, scales back some cyclical exposures, and increases positioning for a potentially softer economy.